Are you planning to invest in Pagibig MP2 savings? This guide will explain everything you need to know before getting started. There’s so much volatility when investing. That’s why finding a stable and rewarding savings platform is a treasure.

The Pag-IBIG MP2 Savings program offers Filipinos a unique, government-backed investment opportunity that promises impressive returns and supports nation-building. This guide provides a comprehensive overview of the Pag-IBIG MP2 Savings program, its advantages, and how one can start investing in it.

What is Pagibig MP2 Savings?

The Home Development Mutual Fund (HDMF), more commonly known as Pag-IBIG (short for Pagtutulungan sa Kinabukasan: Ikaw, Bangko, Industria at Gobyerno), was established to provide Filipinos with a nationwide savings system and affordable housing financing.

Watch this video to learn more about Pagibig MP2 fund:

The Pagibig MP2, or Modified Pag-IBIG II, is a voluntary savings scheme launched by the Pag-IBIG Fund to supplement its regular savings program. It’s designed specifically for members who wish to save more and earn higher dividends than the regular Pag-IBIG savings program.

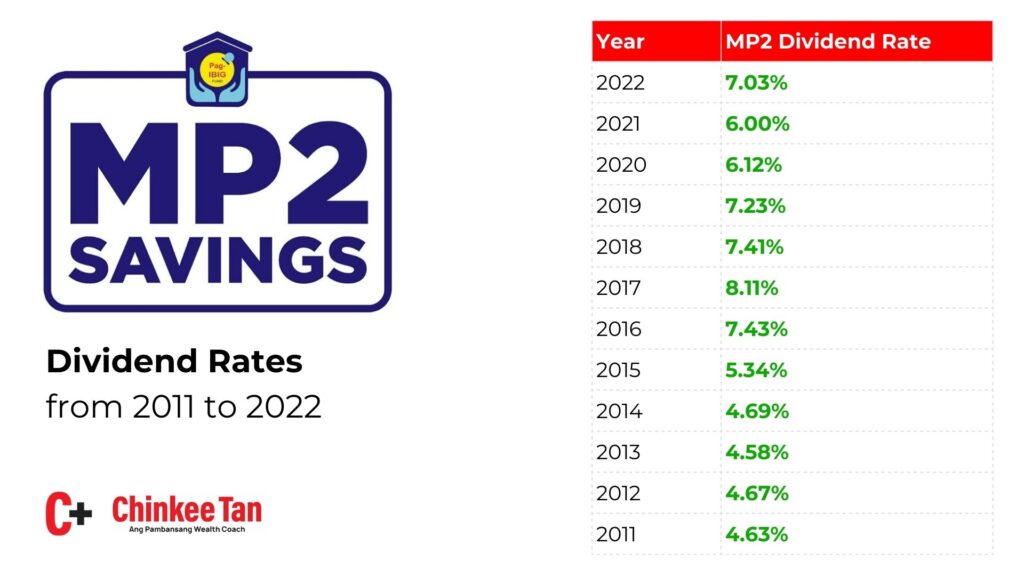

Check out the savings rate performance from the past few years:

Key Features and Benefits of Pagibing MP2 Savings

These are some key features and benefits of Pagibig MP2 savings to help you understand it better:

- High Dividend Rates: Unlike traditional savings or time deposits in banks, MP2 dividends are derived from the Fund’s annual net income, making it potentially higher. The actual rate can vary yearly, but it has historically outperformed many commercial bank rates.

- Tax-Free Dividends: The earnings from MP2 Savings are tax-exempt, ensuring that members benefit from their savings.

- Guaranteed by the Government: MP2 Savings is backed by the Philippine government, ensuring the safety and security of members’ savings.

- Flexible Contribution: While the regular Pag-IBIG savings program has a fixed monthly contribution, MP2 offers flexibility. Members can decide on their monthly contributions, allowing them to invest based on their financial capability.

- Short Maturity Period: MP2 has a maturity period of 5 years, after which members can choose to withdraw their savings or let it roll for another five years, continuously earning dividends.

Why Should I Invest in MP2?

So why should you invest in Pagibig MP2? When deciding where to park your hard-earned money, there are several factors to consider: return on investment, safety, flexibility, and ease of transaction.

The MP2 Savings program ticks all these boxes. These make it a compelling choice for seasoned investors and those starting their savings journey. Let’s discuss these advantages:

1) Competitive Dividend Rates

In an era where traditional bank savings accounts offer meager interest rates, the MP2 program frequently boasts annual dividend rates that surpass these conventional savings mechanisms. This means your money works harder without you taking on excessive risks.

2) Security and Peace of Mind

Being a government-backed program, the MP2 Savings program is virtually risk-free. While no investment is 100% without risk, the backing of the Philippine government provides members an additional layer of assurance.

3) Flexibility for All

Whether you’re a high-income earner or someone with a tight budget, MP2’s flexibility in terms of contribution allows for a tailor-made savings plan. You decide how much you want to save monthly, ensuring you don’t overextend your finances.

4) Tax-Free Growth

Taxation can eat into your savings or investment growth. But with MP2’s tax-free dividends, you’re assured that every peso you earn as a dividend goes straight to your pocket, maximizing your overall returns.

Do You Want to Grow Your Wealth and Experience Financial Success?

Learn how to leverage investment tools and principles when you join this upcoming free webinar: How to Create Money-Making Machines and Multiple Sources of Passive Income.

Here, I’ll teach you all you need to know to grow authentic wealth while building a life filled with joy and contentment. You’ll also learn tips and strategies to grow your income no matter your industry. This training is perfect for employees, aspiring entrepreneurs, existing business owners, and OFWs.

And like I said, this training is absolutely free! So don’t miss this chance. Slots are limited, so sign up now by clicking on the button above or the link below.

How to Invest in Pag-IBIG MP2

Starting your investment journey with Pag-IBIG MP2 is a straightforward process. Depending on your preference, you can choose to enroll online or go through the manual enrollment procedure. Below are step-by-step guides to both processes:

Pag-IBIG MP2 Online Enrollment Process

- Visit the virtual Pag-IBIG MP2 enrollment page.

- Enter your Pag-IBIG Membership ID (MID) number and other required personal details.

- Input the “CAPTCHA code” displayed on the screen and click “Submit” to proceed.

- In the “Desired Monthly Contribution” field, indicate the amount you wish to contribute each month.

- Based on your financial strategy and needs, select from the following options:

- Dividend payout: Decide how you’d like to receive your dividends.

- Payment mode: Choose your payment method, whether through salary deduction, over-the-counter, or other available modes.

- Source of funds: Indicate the origin of your investment, be it from personal savings, salary, or other sources.

- Click “Submit” to complete the online registration process.

- A form displaying your 12-digit MP2 savings account number will appear upon successful enrollment. It’s essential to save this document as a PDF or print it for your records and future reference.

Pag-IBIG MP2 Manual Enrollment Procedure

- Locate and visit the nearest Pag-IBIG branch to your location.

- Approach a Pag-IBIG officer to request an MP2 Enrollment Form. Alternatively, you can download the form from the official Pag-IBIG website before your visit.

- Carefully input all required information on the MP2 Enrollment Form, including your Pag-IBIG MID number.

- Specify the amount you plan to contribute each month in the designated field.

- Specify Your Preferences: Choose your desired options concerning the following:

- Dividend payout: Select how you wish to receive your dividends.

- Payment mode: Indicate your preferred payment method.

- Along with the completed enrollment form, provide the necessary Pag-IBIG MP2 requirements:

- A photocopy of a valid government-issued ID (like a passport or driver’s license).

- Proof of income, which could be in the form of a payslip, certificate of employment, or any relevant document.

- Make the first contribution as instructed by the Pag-IBIG officer assisting you.

- Retain a copy of the filled MP2 Enrollment Form and the receipt as evidence of your successful enrollment.

Pag-IBIG MP2 Payment Options

Navigating through the modes of payment for the Pag-IBIG MP2 can be a breeze if you’re familiar with the available options. From traditional salary deductions to tech-savvy online channels, there’s a convenient method for everyone.

Salary Deduction

If you’re currently employed and your employer actively participates in the Pag-IBIG MP2 Salary Deduction Program, this mode can be seamless. Your monthly contributions are automatically deducted from your salary, ensuring timely payments without the hassle.

Over-the-Counter Payment

For those who prefer making transactions in person, you can easily walk into any Pag-IBIG branch or their accredited payment centers. Whether you’re paying in cash or using a check, the staff will guide you through the process, ensuring your payment is accredited to your MP2 account.

Online Payment Channels

If you’re tech-savvy or appreciate the convenience of online transactions, there are many platforms at your fingertips:

- GCash: A popular e-wallet in the Philippines, GCash allows for quick and easy MP2 payments.

- Coins.ph: Another favored digital wallet that facilitates Pag-IBIG transactions.

- Moneygment: This app not only enables MP2 payments but also provides a range of financial management tools.

- Other Online Facilities: Various online payment services partner with Pag-IBIG, expanding your range of choices.

- Credit Card Options: Whether you have a Maya, Visa, Mastercard, or JCB credit card, you can utilize them for your MP2 contributions.

Online Banking

Many banks in the Philippines have integrated Pag-IBIG MP2 payment services into their online banking platforms. It’s worth checking with your bank to see if this facility is available, offering you an additional avenue to manage your contributions. You can check if your bank will allow online banking transfers for Pagibig MP2 here.

Frequently Asked Questions (FAQs)

Who is eligible to invest in Pagibig MP2?

Understanding eligibility is the first step to unlocking the potential of the Pag-IBIG MP2 Savings Program.

Current Pag-IBIG Fund Members

If you’re already a member of the Pag-IBIG Fund, the door to the MP2 Savings Program is wide open. This includes:

- Local and Overseas Workers: Regardless of your location, if you’re an active Pag-IBIG member, you’re eligible.

- Membership Types: Whether you’re a voluntary contributor, under mandatory employment coverage, or a self-employed individual, MP2 is within your reach.

New Contributors

Haven’t joined the Pag-IBIG Fund family yet? No worries! Prospective members can enroll in the regular Pag-IBIG program and subsequently apply for the MP2 Savings Program, making the scheme accessible even for newcomers.

How much is the MP2 monthly contribution?

The beauty of the MP2 Savings Program is its flexibility. There isn’t a fixed monthly amount; however, the minimum contribution is typically set by Pag-IBIG. Participants of the Pag-IBIG MP2 savings program must contribute at least PHP 500 monthly from their earnings, but they can increase their contribution up to PHP 25,000 monthly based on their income.

How much do I need to invest in Pag-IBIG MP2?

The initial investment or contribution depends on your financial capability and goals. While there is a set minimum amount, there’s no maximum limit, allowing you to invest as much as you’re comfortable with.

Can I withdraw my MP2 savings before 5 years?

The MP2 is a five-year term savings program. Early withdrawal is possible but might come with certain conditions. Some of those conditions include:

- Total disability or insanity

- Separation from service due to health reasons

- Death of the member or immediate family member

- Retirement (except for when the MP2 Saver is already a retiree)

- Permanent departure from the country

- Distressed member due to unemployment (layoff or company closure)

- Critical illness of the member or immediate family member, certified by a licensed physician and approved by Pag-IBIG Fund

- Repatriation of an Overseas Filipino Worker member

- Other approved meritorious grounds by Pag-IBIG Fund

Can I pay for MP2 in one lump sum?

Absolutely! If you have the means and prefer to make a one-time payment rather than monthly contributions, you can opt for a lump sum payment. This can be especially advantageous if you’re considering the compounding effect of dividends over the 5-year term.

Final Words

Investing in the Pag-IBIG MP2 Savings Program offers Filipinos a fantastic avenue to grow their savings securely and hassle-free. Whether you’re an existing member of the Pag-IBIG Fund or someone looking to dip their toes into the world of savings and investments, MP2 provides a flexible, accommodating platform.

The MP2 program stands out as a top choice for those wanting to take control of their financial future. As always, research and consult with Pag-IBIG’s official channels and make informed decisions that resonate with your financial aspirations. Your future self will undoubtedly thank you for your prudent steps today!

Chinkee Tan is a Wealth Coach, Keynote Speaker, and Best-selling Author on personal finance and wealth management. He has written 16 best-selling books and counting. His mission is to equip millions of Filipinos to be free from financial stress & experience financial freedom.